19+ nh payroll calculator

For example if an employee earns 1500. Ad See the Payroll Software your competitors are already using - Start Now.

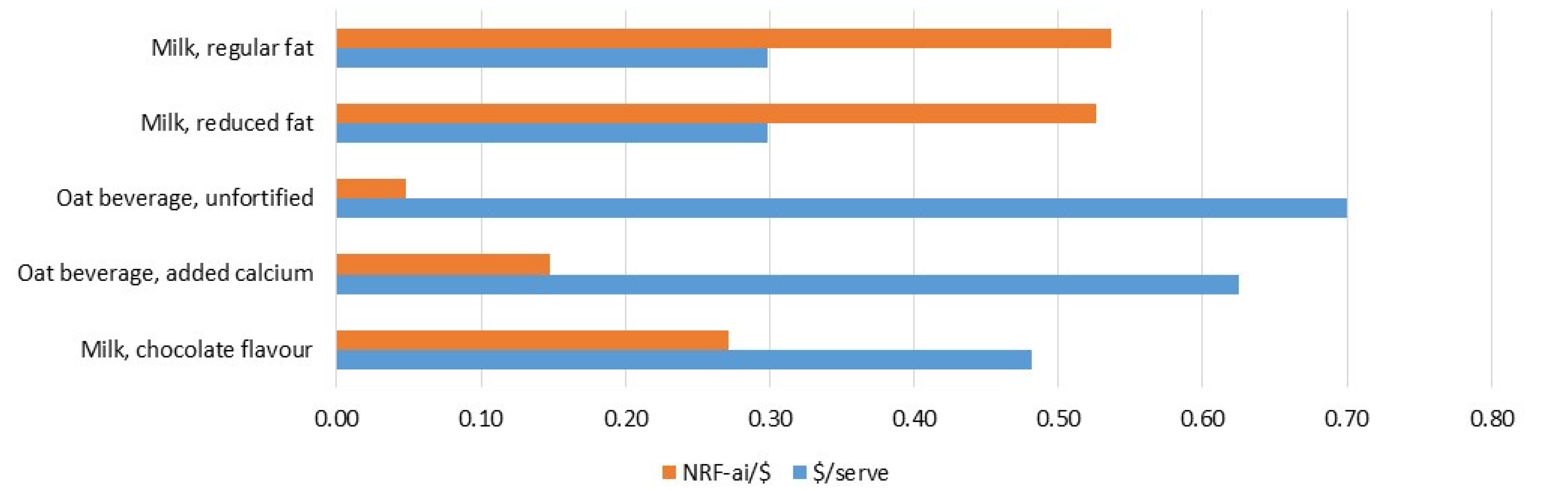

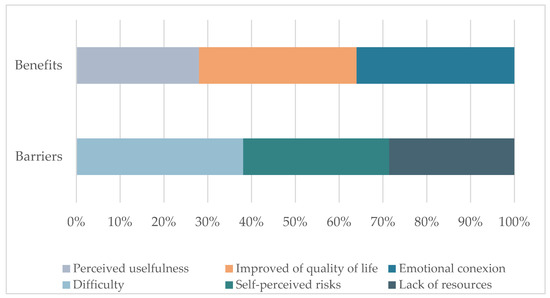

Foods Free Full Text An Alternative Nutrient Rich Food Index Nrf Ai Incorporating Prevalence Of Inadequate And Excessive Nutrient Intake Html

No state-level payroll tax.

. Get Your Quote Today with SurePayroll. Based Specialists Who Know You Your Business by Name. Ad Get Started Today with Your Free 3 Month Trial.

We designed this handy. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

How to calculate annual income. Calculating paychecks and need some help. Ad Process Payroll Faster Easier With ADP Payroll.

Payroll So Easy You Can Set It Up Run It Yourself. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Discover ADP Payroll Benefits Insurance Time Talent HR More.

19 45 20 46 21 47 22 48 23 49 24 50 25 51. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Back to Payroll Calculator Menu 2013 New Hampshire Paycheck Calculator - New Hampshire Payroll Calculators - Use as often as you need its free.

GetApp has the Software you need to stay ahead of the competition. Payroll pay salary pay. Features That Benefit Every Business.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New Hampshire. Calculate your New Hampshire net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New. This free easy to use payroll calculator will calculate your take home pay.

Ad Compare This Years Top 5 Free Payroll Software. Supports hourly salary income and multiple pay frequencies. New employers should use.

Need help calculating paychecks. Free Unbiased Reviews Top Picks. Can claim state exemptions.

How much you pay in. If you earn normal wage there is no income tax. Ad Process Payroll Faster Easier With ADP Payroll.

All Services Backed by Tax Guarantee. Discover ADP Payroll Benefits Insurance Time Talent HR More. Get Started With ADP Payroll.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for. For 2022 New Hampshire unemployment insurance rates range from 01 to 85 with a taxable wage base of up to 14000 per employee per year. New Hampshire tax year.

How Your New Hampshire Paycheck Works Even in a state like New Hampshire that does not levy income tax on wages workers still have to pay federal income taxes. New Hampshire Hourly Paycheck Calculator. Get Started With ADP Payroll.

COVID-19 Employer Toolkit Diversity Equity and Inclusion Toolkit. Discover a wealth of knowledge to help you tackle payroll HR and benefits and compliance. Ratings for New Hampshire Paycheck Calculator.

New Hampshire Paycheck Calculator Use ADPs New Hampshire Paycheck Calculator to. Ad Payroll Made Easy. New Hampshire Hourly Paycheck and Payroll Calculator.

State of New Hampshire.

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Plenarvortrage Dpg Tagungen

Ijerph August 2 2022 Browse Articles

Simple Payroll Tax Calculator Free Paycheck Calculation

New Hampshire Hourly Paycheck Calculator Gusto

New Hampshire Salary Calculator 2022 Icalculator

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Payroll Tax Calculator Screen

Goldenkey Meraki Resale Price Flats Properties For Sale In Goldenkey Meraki Hyderabad

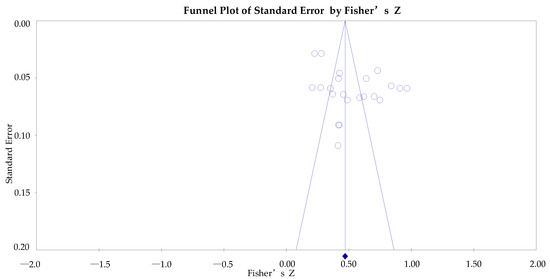

Full Article Cost Effectiveness Of Adding Carfilzomib To Lenalidomide And Dexamethasone In Relapsed Multiple Myeloma From A Us Perspective

Pdf Comn Catalysts Derived From Hydrotalcite Like Precursors For Direct Conversion Of Syngas To Fuel Range Hydrocarbons

Ijerph August 2 2022 Browse Articles

New Hampshire Paycheck Calculator Tax Year 2022

How To Calculate Payroll Taxes Wrapbook

Using Computable Knowledge Mined From The Literature To Elucidate Confounders For Ehr Based Pharmacovigilance Sciencedirect